Credit Unions Near Me

Unlike banks, credit unions are not for profit organizations that exist to serve their members. Like banks, credit unions are tasked with accepting deposits, making loans, and providing a wide array of other financial services to its members.

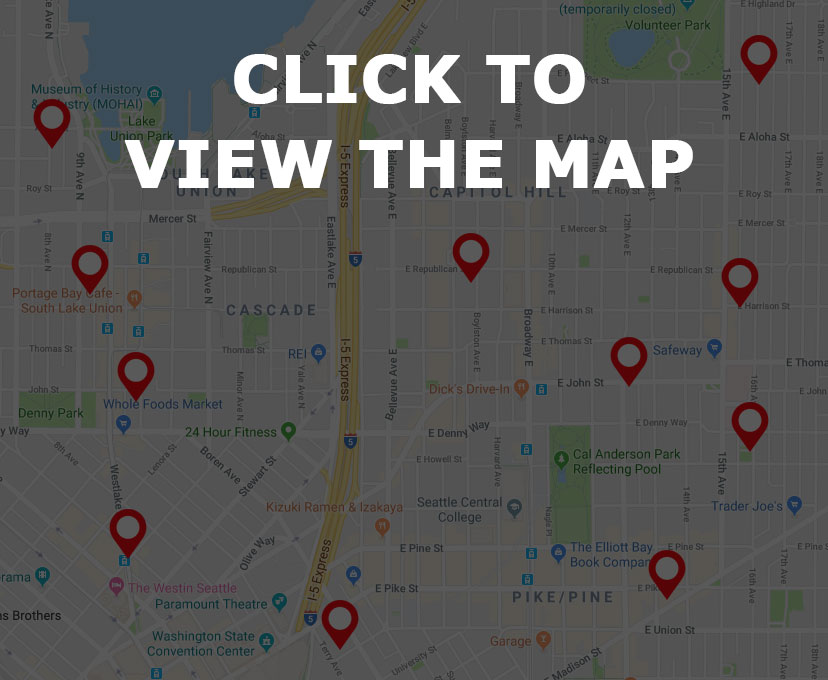

Are you interested in finding a credit union near you? Simply browse credit unions near me on the map below and find a list of credit unions located within a close proximity to you. Need a bit more information on credit unions? Read on for interesting facts, trivia, and history on credit unions.

Credit Unions Near Me – Find it on the Map

Credit Unions Near Me – Credit Unions Trivia

When were credit unions first established?

Many individuals think that credit unions are a very recent endeavor, when in fact, modern credit union history dates back to 1852. This is when Franz Hermann Schulze-Delitzsch consolidated the learning from a total of two pilot projects, one in Delitzsch and one in Eilenburg. These are considered to be the first established credit unions in the world. They also allowed for the first successful urban credit union system. In 1864, Friedrich Wilhelm Raiffeisen founded the very first non-urban credit union in Heddesdorf Germany. By the time he passed away in 1888, credit unions had spread like wildfire to areas such as Italy, France, the Netherlands, England, Austria, and other nations. The first ever credit union in North America was the Caisse Populaire de Levis in Quebec, Canada, which began operations in 1901 with a meager 10 cent deposit. The founder, Alphonse Desjardins, was moved to take on the role in 1897 when he first learned of a Montreal resident who was ordered to pay nearly $5,000 in interest on a loan of $150. Consider these rich historical facts as you search credit unions near me.

Credit options are an excellent choice for those wishing to deviate from traditional banks.

How many credit unions exist in the world?

If you’re searching credit unions near me, you may be wondering just how many credit unions currently exist in the world. According to figures released by the World Council, there were more than 57,480 credit unions spread over 105 countries as of 2014. Collectively these credit unions served more than 217.4 million members which oversaw more than $1.79 trillion in US assets. Be aware that this figure does not include any data from co-operative banks, so countries who are pioneering in credit unionism, such as Germany and France, are not typically included in the data released by the World Council. The countries that currently have the most credit union activity are highly diverse. According to the World Council, the countries with the greatest number of credit union members were the United States (101 million), India (20 million), and Canada (10 million).

Credit Unions Near Me – Credit Unions Facts

The Overseers

Anyone searching credit unions near me would like some assurance that the credit union they choose is being overseen by a higher authority, this can mean insurance if something goes wrong. In the United States, Federal credit unions are chartered and officially overseen by the National Credit Union Administration. This agency not only oversees credit unions, they also provide deposit insurance, similar to how the FDIC provides deposit insurance to banks. State chartered credit unions are typically overseen by whatever financial regulation agency the state employs. Many, but not all, are required to obtain deposit insurance. This is something you will need to check into prior to signing up with a credit union. Because of problems with bank failures in the past, most states will not provide any kind of deposit insurance, which means private companies are to be hired. Unlike the US, most Canadian credit unions are provincially regulated, with deposit insurance always being provided by the Provincial Crown Corporation.

Different From Banks

Credit Unions and banks may share some similarities, but they also have some major differences. For one credit unions are nonprofit organizations, unlike banks which are for profit corporations. Credit unions typically offer many of the same financial services as banks, but often employ different terminology. For example share accounts are essentially savings accounts and share draft accounts are checking accounts. Share term certificates are no different from certificates of deposit and credit cards are the same for both institutions. Both agencies also offer online banking and mobile apps. Traditionally speaking, only a member of a credit union may deposit or borrow money from the institution. Most studies indicate that customers tend to have a higher degree of customer satisfaction when working with a credit union rather than a bank. This is because credit unions are not out of profit, which generally means they are more concerned with customer satisfaction than accumulating profit from fees or customer woes.