ATMs Near Me

Debit cards may be the most popular way to pay, but nothing beats the feeling of cold hard cash. Not only is carrying cash seen as a more fervent way to stay on budget, but many small businesses and restaurants still operate on a cash only model. Despite the advent of on the go payment services such as Square, there are times when one needs cash in a hurry. Unfortunately, visiting a bank to manually withdraw isn’t always an option. Luckily, most cities and towns have plenty of ATMs to help you get cash quickly and safely.

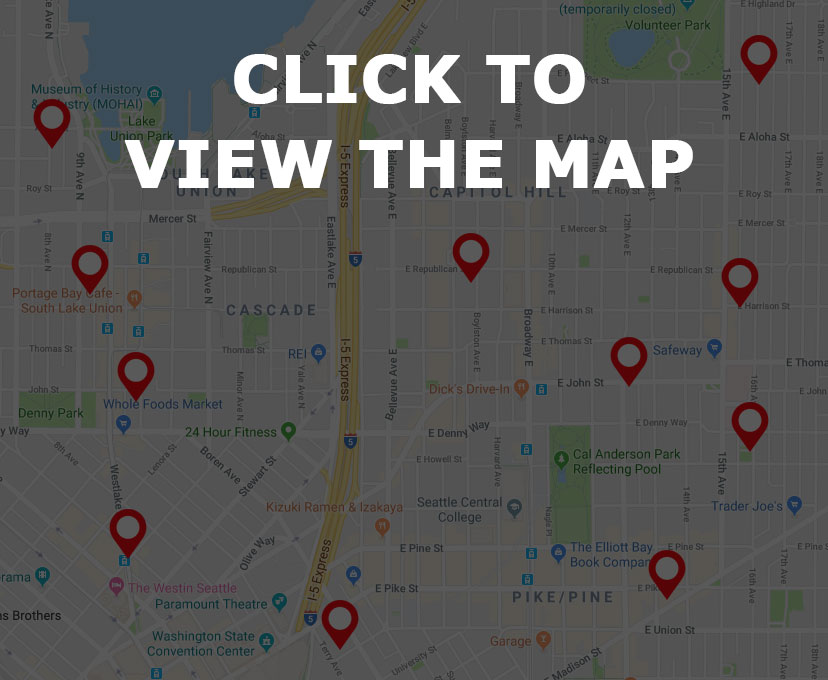

Are you interested in finding ATMs near you? Simply browse ATMs near me on the map below and find a list of ATMs close to your current location. Looking for more information on ATMs and banking? Read on for facts, trivia, and tips that could save you a bit of dough!

ATMs Near Me – Find it on the Map

ATMs Near Me – ATMs Trivia

When was the first cash dispensing machine actually invented?

ATMs might seem like a fairly modern invention, especially given the country’s love affair with debit and credit cards, but the first cash dispensing machine is actually quite old. When was the first cash dispensing machine actually invented? Consider this as you search ATMs near me. According to historians, the very first cash dispensing machine was conceptualized and brought to life by Luther George Simjian back in 1939. Simjian saw a need for fast cash and thought the machine might make the day to day flow of life a little easier. The bulky mechanical cash dispenser was first set up on a trial basis in New York City at the City Bank of New York. While there was interest in the machine at first, popularity quickly waned. The machine was removed after just six months due to a lack of customer acceptance. People just weren’t interested in a machine that could dispense cash, deeming it a bit unsafe. In fact, it’s reported that the only people who used this early ATM were unsavory characters who didn’t want to face a teller. Nowadays, it’s hard to imagine life without ATMs!

ATMs can put cash right at your finger tips!

When was the first free standing ATM installed?

Though people were slow to take to the concept of an ATM machine, training simulators made it possible for more people to understand how the machines worked and what benefits they provided. When was the first free standing ATM actually installed? Consider this as you search ATMs near me? The very first free standing electronic ATM machine was first installed in 1969. The Chemical Bank took the steps to install the machine outside of a branch in Rockville Centre in New York. The device is regarded as the first machine to have utilized a magnetic strip on plastic cards in order to read information. Despite the advent of the free standing ATM, the machines didn’t gain popularity until 1973. This is when more than 2000 machines were sold and distributed all across the United States. While people were happy for the convenience, bankers were not onboard with the cost of purchasing and installing an ATM machine. These early machines cost around $162,000 to purchase and roll out. Today, the typical ATM machine can be bought for just under $3,000. That’s probably why ATMs are so prevalent in the modern day!

ATMs Near Me – ATMs Facts

The Most Popular ATM Day

ATMs might be popular every day of the week, but there’s one day that ATMs get more use than any other. So what exactly is the most popular day for ATM usage in the United States? Consider this as you search ATMs near me. According to statistics, the most popular day for ATM use is on a Friday. This shouldn’t come as a surprise given that most Americans receive their weekly paychecks on a Friday. This is also the day of the week when most Americans hit up bars and clubs. While some bars do take cards, many smaller establishments are cash only. Right now, there are more than 420,000 ATMs in the United States alone. That’s more than any other country in the world. The figure is high, but it’s not going to last for long. ATM usage is dropping at an alarming frequency. Between 2010 and 2015, ATM transactions dropped by a staggering 15%. The reason? More and more businesses are taking debit and credit cards. There’s not always a need to have cash on hand. Some people consider cash to be clumsy and more time consuming. Though cash is thought to be a more budget conscious way to pay (you can physically see and fee how much money you have left to spend), others argue that it’s easier to spend cash than to carry a card.

ATM Scams

Unfortunately, the one downside of using an ATM machine is the potential to be duped by a scammer. Now more than ever, ATM scams are sweeping the nation. As you search ATMs near me, keep these popular scams in mind. You might just protect your wallet and your identity. Right now, more and more scammers are relying on devices called skimmers to steal card numbers and gain access to bank account information. A skimmer is often placed where the card reader on the ATM goes. The device records details from the magnetic strip of a card. Because of this, criminals can harvest data from every single person that swipes their card at an ATM. Skimmers are also equipped with miniature cameras that are designed to capture PIN numbers as they’re being entered. To ensure that the machine you’re using does not have a skimmer, jiggle the card reader on the ATM. If it is loose, shaky, or possibly not fully attached, it might be a skimmer. You’ll also want to look for fake keypad overlays which can capture your PIN in real time. Information is then transferred to the crooks via wifi. If a keypad ever feels loose, thick, or sponge like, it might just be a fake. Take steps to protect yourself while visiting an ATM and you’ll stay safe. If something doesn’t seem quite right, don’t use the ATM. Either go into the physical bank or find another machine to use in a different area.