Car Insurance Companies Near Me

Finding the right car insurance company can seem like a daunting experience. After all, you don’t want to overpay for great service, but you also want to be prepared for every possible situation that could come your way as a car owner. There are dozens of car insurance companies that boast the best service and the lowest prices, but how can you know which is the right service for you? With a little bit of time, research, and patience you can find the best car insurance company for the job.

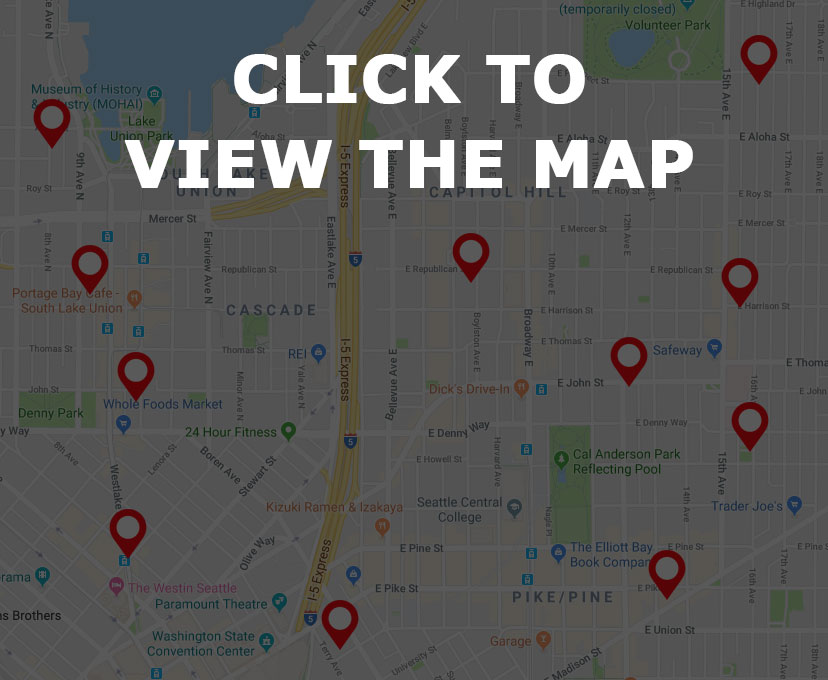

Are you interested in finding car insurance companies near you? Simply browse car insurance companies near me on the map below and find a list of car insurance companies in your area. Need more information on finding the best car insurance company? Read on for interesting facts, trivia, and tips on buying car insurance!

Car Insurance Companies Near Me – Find it on the Map

Car Insurance Companies Near Me – Car Insurance Companies Trivia

True or false: You should always ignore small local car insurance agencies.

This is absolutely false! When searching car insurance companies near me, you may be tempted to balk at the little man or local agents who represent bigger companies. This can be a detrimental mistake, especially if you’re trying to save money while getting the most bang for your buck. Though half of the nation’s auto insurance business is handled through Allstate, Geico, Progressive, or State Farm, many experts agree that small regional insurers such as Erie and Auto Owners can boast the highest customer satisfaction ratings. In fact, more people reportedly satisfied with the level of service, care, and rates given at smaller more regionally focused offices. Not only will dealing locally give you the opportunity to speak with a person directly, either face to face or over the phone, but it can earn you major discounts. Thinking big is great sometimes, but often the best things really do come in small packages.

Finding great car insurance starts with a simple search!

Can your credit score affect your car insurance rates?

One thing you might not consider while searching car insurance companies near me is that your credit score can actually affect your overall car insurance rate quote. This is true in every state except for California, Hawaii, and Massachusetts. In these three states, insurers aren’t allowed to consider your credit when selling rates. So why is credit considered at all in a majority of US states? Some insurance companies claim that customer’s credit is a great indicator of their overall chance of filing a claim. Some believe that those with poor credit tend to file more claims and get in more accidents/altercations, thus costing the car insurance company even more. This is why analysts agree that having poor credit will often boost your car insurance rates by hundreds of dollars a year, especially when compared to individuals who have high credit scores. To earn cheaper insurance, work little by little to improve your credit score. Pay your bills on time and strive to reduce your debt down to manageable levels. You can track your overall progress by checking your credit score with free reporting agencies and keeping a good eye on your overall financial health.

Car Insurance Companies Near Me – Car Insurance Companies Facts

Have an Older Car?

If you have an older vehicle, there are significant ways to cut costs while searching car insurance companies near me. Experts agree that if you have an older vehicle, you may want to skip collision and comprehensive. You might think this is a risk, but there are great reasons to go ahead and leave this cost in the dust. Collision coverage pays to repair the damage your vehicle endures after an accident with another car or even an inanimate object such as a tree or fence. Comprehensive coverage pays to repair any vehicle damage that occurs because of weather, animal crashes, vandalism, fire, and floods. Comprehensive value can also work to cover car theft should your vehicle be stolen. The maximum payout under either policy is extremely limited by the value of the car if it’s totaled or stolen. If your car is very old and boasts a very low market value, it likely won’t pay you to shell out the extra dough for these two types of coverage. Odds are, even if an event occurs, you won’t get enough to cover a new vehicle or even costly repairs, especially if your car is more than 10 years old.

Pay Per Mile Insurance

One of the the options you may find intriguing while searching car insurance companies near me is “pay per mile” insurance. If you’re a very safe driver who doesn’t use your car to commute long distances every day or you’re someone who only really drives to go to the store or on local outings, you may be a great candidate for a user based insurance program. Programs such as Progressive Snapshot, State Farm’s Drive Safe And Save, and Allstate’s Drivewise, can be great options to help you save some dough while still getting great coverage. Unlike a traditional car insurance program, these options let your insurance company track your driving in exchange for discounts based on how much you drive, when you drive, and just how well you perform behind the wheel. If you do drive less than 10,000 miles per year, pay per mile insurance is also an excellent option. Companies such as Metromile and Esurance offer great pay per mile programs. On these insurance programs, you’ll save more money the less miles you drive per year. If you’re someone who works from home or commutes locally, this can be a great option to save money.