Car Insurance Near Me

Car insurance is a necessity that every driver needs before they can hit the road. Unfortunately, the process of buying car insurance isn’t always straight forward. With so many factors to consider and obvious budget constraints, finding car insurance can often feel like a shot in the dark. Luckily, there are dozens of great car insurance agencies to choose from. You just need to find the one that’s best for you.

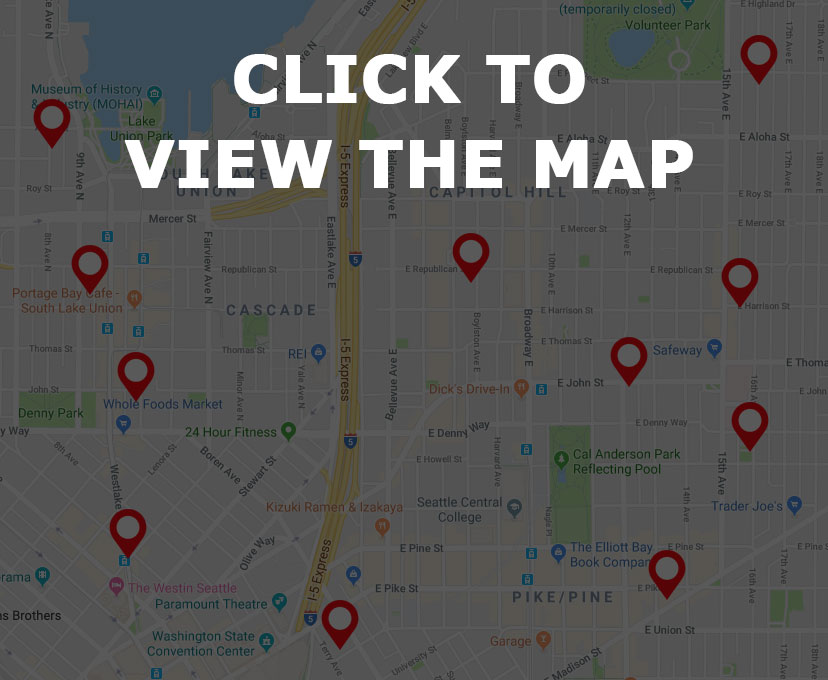

Are you interested in finding car insurance in your area? Simply browse car insurance near me on the map below and find a list of car insurance companies near you. Need a bit more information on finding the best car insurance? Read on for facts, trivia, tips and more!

Car Insurance Near Me – Find it on the Map

Car Insurance Near Me – Car Insurance Trivia

Why are car insurance rates so high in Louisiana?

The one thing you’ll notice while searching car insurance near me is that rates can differ drastically from state to state. The premium you’re paying in rural Ohio might be far less than what someone is paying in New York city. Which state actually has the most expensive car insurance. According to reports, insurance premiums are extremely high in the state of Louisiana. On average, individuals residing the Bayou State will pay 33 percent more than the national average. Much of Louisiana is very rural, this means there are very low crime rates, fewer cars on the road, less traffic, and fewer car accidents. So why exactly is insurance so expensive in Louisiana? Natural disasters. Unlike most states, Louisiana rates high when it comes to natural disasters such as hurricanes. Hurricanes can damage vehicles through flooding, falling trees, and debris thrown by high winds.

A great car insurance provider can help you achieve peace of mind!

True or false: Coverage affects what you pay each month.

While you search car insurance near me, you may be wondering how you can keep your rates down and not bust your budget on high premiums. So what actually affects the price you pay for car insurance? In a word: coverage. The majority of your car insurance premium will generally go towards the legally required liability on your policy. While it can be tempting to reduce the liability portion of your policy in order to save a few bucks, experts advise against doing so. It’s typically not a good idea because in the event of an accident or natural disaster, you will be responsible for any amount of damages above your actual policy limits. So while you may be saving money in the short term, should something happen, you’ll end up paying far more out of pocket should something go wrong. While it’s not recommended to lower liability, there are other coverages that can be reduced or eliminated in order to lower your overall premium. If you have an older car that’s not worth very much or would have no issue paying for a new car, collision and comprehensive coverage may not make good economic sense.

Car Insurance Near Me – Car Insurance Facts

What Affects Car Insurance Rates?

If you’re searching car insurance near me, then you obviously want to get the best insurance package that you possibly can for your car. Every auto insurance company uses a list of certain criteria to help evaluate your insurance application. This process is known as underwriting. Each car insurance company boasts certain guidelines regarding which groups of drivers they wish to accept and how much they will charge groups that they consider to be risky. The guidelines are not standard across every car insurance company, which can make things a bit confusing for drivers looking to find good insurance. Two companies who evaluate the same driver may reach starkly different conclusions on price and overall risk. How you’re evaluated will vary greatly depending on the company you choose. During the initial underwriting process, car insurance applicants are first placed in a group that is built upon how much money they make and how many claims the insurance company infers it may have to pay. This is typically done automatically by software behind the scenes rather than by an actual person. After placing you in a group, the car insurance company will then look at records to see just how many accidents or tickets you’ve received. Many will also use an insurance history report to see just how many car insurance claims a driver has made in their past insurance history. Although most accidents and violations will only affect rates for three years, some companies will go back as far as five or more years to decide if they want to take you on as a customer.

A Higher Deductible

As is the case with most insurances, a higher deductible can mean a lower premium. Insurance prices are generally based on how much money the insurance company believes it could have to pay in the long run due to claims. If you agree to pay for a larger part of your own damages by going with a higher deductible, the car insurance company knows that they likely won’t have to pay as much for your claims in the future. Because of this you can typically get away with having a much lower premium. If you do decided to raise your deductible in order to save money, make sure you can afford to pay the deductible if you should have to make a claim in the future. As you shop car insurance near me, keep in mind just the insurance game works and how you can save money in the present and in the highly unpredictable future.