Car Leasing Near Me

Want to upgrade your car every few years without the hassle? Car leasing may be the best option for you. Vehicle leasing is the leasing of a car for a fixed period of time at an agreed upon amount of money for the lease. It is a common alternative offered by dealers in lieu of a traditional vehicle purchase. Unlike a traditional car purchase, leasing allows you to upgrade to a newer and better model after each leasing period is up. This is perfect for someone who wants a nice car but doesn’t travel much in a given year.

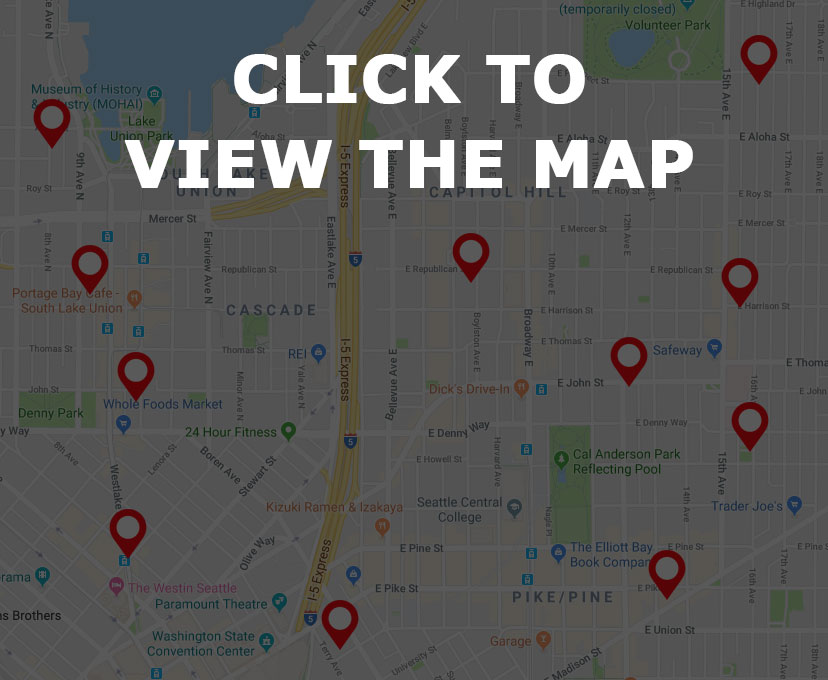

Ready to find car leasing near you? Simply browse car leasing near me on the map below and find a list of car leasing agencies near you. Need a bit more information on car leasing? Read on for interesting facts, trivia and so much more!

Car Leasing Near Me – Find it on the Map

Car Leasing Near Me – Car Leasing Trivia

How many miles can you drive a leased car per year?

Leasing a car can be a great option for many people. However, it is not for those who like to travel by car or who face long daily commutes. The reason? There are limitations on just how many miles you can put on your leased car per year. How many miles can you put on a leased car per year? Read on as you search car leasing near me. Generally speaking, a lease only includes 7,500 to 10,00 miles per year. For a higher monthly fee, you may be able to bump that up to 12,000 miles a year. Limited miles are fine for someone who doesn’t drive much or only faces a five or ten minute commute. For anyone who spends a lot of time in their car, 12,000 miles a year typically doesn’t make the grade. In fact, most people cite driving at least 14,000 miles per year. This is just something to consider before leasing a car and signing on the dotted line. If you go over your allotted miles, you may break your lease and end up paying more.

How much money to put down on a leased car?

If you’re considering leasing a new car and have excellent or good credit, the option to putting money down on a leased car will typically be up to you. Still, many car dealerships will recommend that you make a hefty down payment before being able to drive a car off the lot. Despite this, experts recommend avoiding leases that require a large deposit or payment right off the bat. Consider why as you search car leasing near me.

Leasing a car can be ideal if you want an upgraded vehicle every few years.

When leasing a car, it is smart to avoid down payments at all costs. Leasing a car can help you maximize your overall cash flow. Typing up your money in a lease down payment doesn’t help you or anyone else. Instead of making a down payment of $3,000 or $4,000, which dealerships will recommend, put that money away into a separate account. Rather than spending that dough on the down payment, make higher lease payments out of the account. Choose an interest bearing account for the money and you may even earn a couple of bucks along the way.

By utilizing this method, you are also cutting down on drive-off costs. If you terminate the lease before the end of the lease period of ir your car is totaled or stolen, you will lose the benefit of any down payment anyway. By putting zero money down, you keep the lease in your favor rather than in the dealerships favor.

Car Leasing Near Me – Car LeasingKK Facts

Is insurance more expensive on a leased car?

One of the most lucrative aspects of leasing is that it will typically yield lower monthly payments when compared to traditional financing means. However, what most people don’t anticipate is higher insurance costs. While you will save money on your monthly payments, you will typically pay more to your insurance company. To protect yourself and a bit of cash after a lease, make sure you purchase “gap insurance.”

Gap insurance will cover the difference between the actual cash value of the vehicle and the amount still owed on a lease. As soon as you drive a leased car off of the lot (or any car for that matter), the car is worth far less than what you owe on the lease. If your car is stolen or totaled during the duration of your lease, you will have to buyout of the lease early. Gap insurance will allow you to do that. Next time you search car leasing near me, consider gap insurance.

Does leasing affect your credit score?

Here in America- most of us are slaves to our credit scores. Bad or less than stellar credit can affect your ability to purchase a home, get good rates on car insurance, and buy a car. Does leasing affect your credit score as much as a traditional loan does? Consider this as you search car leasing near me. Here’s the straight facts- taking on a lease affects your credit in the exact same way. When you apply for a lease, an inquiry into your credit is triggered. This has a small adverse effect on your score. Taking on a lease also increases your overall credit utilization.

This also affects your credit score. Over time, your credit utilization will ultimately fall. Making timely payments will cause your score to increase again. Leases are essentially seen as installment loans. Despite affecting your credit score, having a high utilization rate on an installment loan is not as detrimental as having a high utilization rate on credit cards or other forms of revolving credit. As is the case with every form of credit, late or skipped lease payments will ultimately crush your credit score.