Financial Consultant Near Me

Even if you don’t invest or have an expansive portfolio, you may benefit from the services of a financial consultant. A financial consultant can help you to get your finances in order while preparing you for the future and ensuring that all your monetary ducks are in a row.

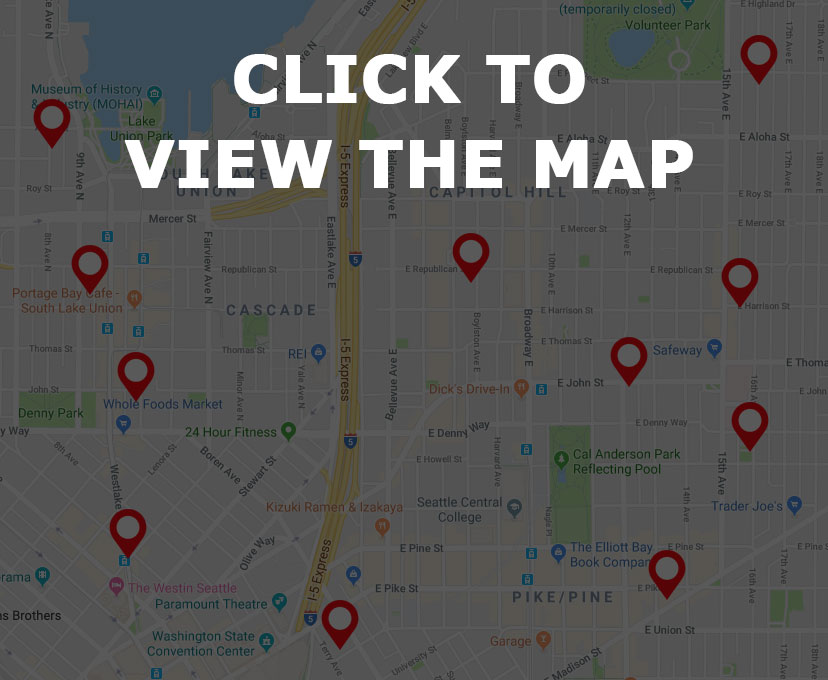

Ready to find a great financial consultant near you? Simply browse financial consultant near me on the map below and find a list of the best financial consultants in your local area. Need a bit more information on financial consulting? How about some tips on finding the best financial consultant in your area? Keep reading for facts, trivia, and so much more!

Financial Consultant Near Me – Find it on the Map

Financial Consultant Near Me – Financial Consultant Trivia

What do financial consultants do?

Now that you’re on a journey to find a financial consultant near me, you’ll need to know exactly what these financial whiz kids can do. A financial consultant works with you one on one to develop an individualized financial plan for savings, retirement, investments and insurance. They help to map out your financial present and future.

If you’ve ever struggled to organize your finances or spend time worrying about how you’ll fare in retirement, a financial advisor can help to ease some of your woes and get a great plan into action today. Whether you make a little money or a whole lot, a financial advisor can help you to make the most of what you have. They can also advise on investments and help you to create a portfolio that can earn you a primary or secondary income.

True or false: You only need a financial advisor if your portfolio is complex.

People with complex investment portfolios will obviously require the help of a financial consultant. What about those of us who don’t have such portfolios? According to experts, even if you don’t have a complex investment portfolio you can still benefit from working with an advisor. Here’s the thing- life itself is complex. On our own, we often fail to anticipate for the curveballs life can throw our way.

A great consultant can help you prepare for your financial future.

That’s why having a financial consultant is smart whether you have investments or not. Sure, if you have investment goals, a financial planner is a must. But say you simply want to save for your child’s education or retirement at age 55 rather than 65. A financial advisor can help you to achieve those goals and potentially build an investment portfolio that makes those dreams a reality. While you search financial consultant near me, consider how they can help you to achieve the financial freedom you desire.

How much do financial advisors make per year?

They say money goes to money and that is definitely the case when it comes to financial advisors. Just how much does the average financial advisor make per year? Read on for the answer as you search financial consultant near me. According to the US Bureau of Labor Statistics the average financial advisor earns around $90,530 annually. The highest paid 10% of financial advisors can earn more than $208,000.

Those with high profile clients such as CEOS or celebrities will earn even more. Does that mean paying for a financial advisor is out of reach? Absolutely not! What you pay is often on par with where you live and the general economy of the area. If you live in a more rural area where cost of living is low and wages below the national average, you can expect to pay a fair going rate. If you live in an urban area, expect to pay a bit more.

Financial Consultant Near Me – Financial Consultant Facts

When To Hire A Financial Advisor

If you’re searching financial consultant near me, then you’re already taking steps to hire a financial advisor. But when is it really necessary to get a professional involved with your finances? First things first, if you’re undergoing or planning on making a big life change, consult with an advisor. Getting married or divorced, having a baby, buying a house, taking care of aging parents and starting a business are all great reasons to seek help and get your finances in order.

Another great reason to hire a financial advisor is if you change jobs, make more or less money, or if your investments have grown. Whenever your financial life changes, it may be worth hiring a consultant to help you grow along with those changes. Going it alone may save you money short term, but finding help may help you achieve greater financial freedom down the road.

Additionally, it is a good idea to hire a financial advisor if you need to be held accountable or if you’re in need of a reality check. Sometimes, you might think you’re doing just fine or that your financial world is in order. Odds are, there are things that could be done better. Even if you don’t take on a financial advisor long term, simply meeting with an advisor a few times can help you to garner the perspective and skill you need to put your best financial foot forward.

What is a robo advisor?

Want to save a little money while searching financial consultant near me? Opt for a robo advisor. A robo advisor is a low-cost computer algorithm that will set up and manage your finances or investment portfolio for you. All you have to do is answer a questionnaire from the company you select as your robo-advisor provider. These questions will identify your goals, strengths, weaknesses, and investing preferences.

Based on the information you provide, the robo-advisor algorithm will recommend the steps you need to take and any investment portfolios that may be a good fit for you. Once you select your path, the robo-advisor takes care of the rest. Some robo-advisors also offer financial planning resources. This can be great for someone who needs a bit of direction but doesn’t want to use an actual in person advisor or pay the cost of a human advisor. While a robo advisor isn’t a great fit for everyone, it can be helpful to most!