Keybank Near Me

Banking is a necessary part of life, but when it comes to your personal finances, not every bank is the perfect fit for your overall needs. When you choose a bank, you’ll want to consider whether it’s for personal or business use. Then look into any fees that might apply to a particular type of account. Keybank is known for offering several account options to help you find the perfect fit for your financial situation.

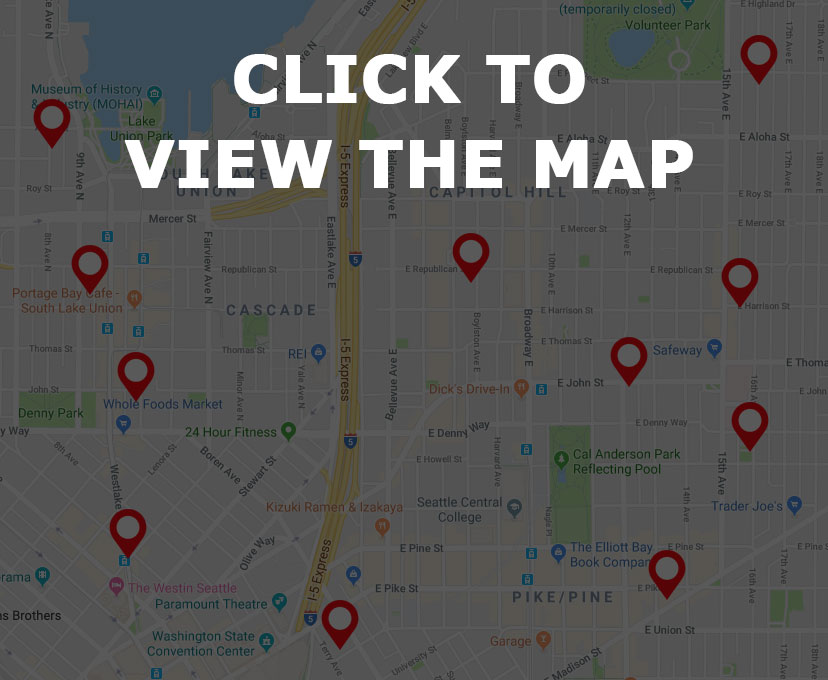

Are you interested in finding a Keybank location near you? Simply browse Keybank near me and find a comprehensive list of Keybank locations in your local area. Need a bit more information on Keybank? Read on for interesting facts, tips on finding the perfect bank account, and trivia questions to keep you on your toes!

Keybank Near Me – Find it on the Map

Keybank Near Me – Keybank Trivia

What states does Keybank operate in?

If you’re searching keybank near me, you’ll want to know exactly which states are currently operating Keybank locations. According to brand statistics there are 1,217 KeyBank branches and 1,500 ATMs. These are located in Alaska, Colorado, Connecticut, Florida, Idaho, Indiana, Massachusetts, Maine, Michigan, New York, Ohio, Oregon, Pennsylvania, Utah, Vermont, and WAshington. The bank also maintains business offices in a total of 31 states. Odds are if you’re looking for a Key Bank location, you won’t have any trouble finding one in your area!

Keybank is one of the nation’s premier banking destinations!

What year was Keybank first formed?

Though Keybank might be a well known financial institution in the modern day, this brand is fairly new in terms of years of operation. When exactly was Keybank formed? Consider this as you search Keybank near me. Keybank was first formed as a subsidiary of KeyCorp, which was officially formed in 1994. The brand was the product of a merger between Society Corporation of Cleveland and KeyCorp of Albany, New York. After the merger was completed, Keybank very briefly held the title of the 10th largest US bank. Despite being only a few decades old, the roots of Keybank can be traced all the way back to the first Commercial Bank of Albany in 1825 and Cleveland’s iconic Society for Savings which was founded in 1849.

Who sets the interest on your savings account?

If you’re searching Keybank near me, you might be interested in opening a savings account in addition to a regular checking account. While this is a fairly simple process, there are some things to keep in mind. For example, who sets the interest on your savings account? Well, the interest accrued is influenced by many factors. The Federal Reserve influences the rate you earn and also controls the federal funds rate. This is the rate at which financial institutions can lend money to one another in the overnight banking hours. That rate tends to have a big influence over short term rates in banking, most notably for personal savings accounts. When the fed officially goes ahead and raises federal funds rates, savings accounts will may just get a bump. The increase isn’t immediate, but it can impact you in a short term way. Of course, this depends on the type of account you are opening and the actions your bank takes in regards to raising interest rates.

Keybank Near Me – Keybank Facts

Fraudulent Activity

One of the biggest headaches any consumer will face in the course of banking is fraudulent charges. Even if you’re the type of person who takes great strides to ensure safety and security, there is never a guarantee that your info won’t be stolen. When you suspect fraudulent activity, you’ll want to notify your bank as quickly as possible. Often times you won’t be on the hook for the charges if you call up your bank as soon as you notice something is a bit off. If you lose your debit card or feel as if your PIN number or password may have been compromised, don’t hesitate to act. According to federal regulations, you are only liable for a maximum of $50 as long as you notify your bank of the fraudulent activity within two business days. If you choose to wait longer than the two day period, your liability can skyrocket to $500 or even more. If you’re searching Keybank near me and aren’t the the type of person who checks your statements regularly, you may be unaware of your information being lost or stolen. No matter when you find out about the charges, call your bank right away. Many will have a 60 day grace period for strange or suspicious activity on your account.

Are online banks better?

If you’re searching Keybank near me, then you might prefer a brick and mortar establishment to an online bank. But which type of bank is actually better? Well, both physical and online banks have benefits and drawbacks. Generally speaking, online banks can offer higher interest rates on a savings account than a physical bank. Online banks save money by not operating storefront branches. This means they can afford to offer higher interest rates than the national average which is .06 percent. For this reason alone, many online banks are leaders in offering the highest yielding savings account. If you’re looking for a savings account that will accrue interest in a timely manner, you may want to look into an online banking situation to suit your needs. Remember, when choosing a bank, you need to weigh the options and consider every feature present on your checking account. Since most banks offer several types of accounts, you’ll want to consider service fees, overdraft protection, FDIC insurance, and other amenities that can help to make your banking experience far more pleasant.