Loans Near Me

No matter where you live or what your income is, there will likely be a time in your life where you require a loan. Sometimes loans are taken out for something as simple as having the lawn reseeded. Other times, they are taken out for homes or vehicles. The type of loan you need depends on what you will be using the loan for. Each has their own set of requirements, interest rates, and processes.

Are you interested in finding loans near you? Simply browse loans near me and discover banks and businesses offering loans near your current location. Need a bit more information on loans and loan types? Read on for interesting facts, trivia, and so much more!

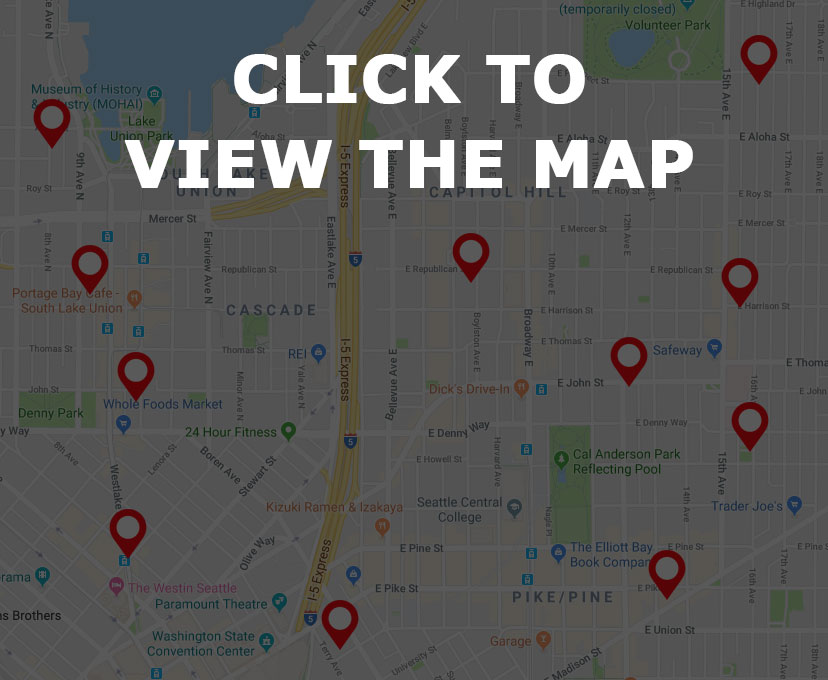

Loans Near Me – Find it on the Map

Loans Near Me – Loans Trivia

How many types of loans are there?

In a nutshell, a lot. Many of us are pretty naive to the fact that there are many types of loans, each serving a specific purpose. Though it may seem as if loans are a one size fits all affair, financial experts would quickly tell you otherwise. Consider these facts as you search loans near me. Whether you’re looking to buy a new home or need to do some considerable remodeling to the one you already own, you are probably going to need a loan to make it happen. In order to choose the one that best suits your unique financial needs, you’ll have to do some digging and find out which loan is perfect for you. So just how many loan types are there? There’s a whopping seven types of loans to choose from. Finding the right one for you might seem impossible, but with a little research, and reading, you can accurately pinpoint the loan that will make sense for your financial situation.

There are many types of loans to suit every financial need you may encounter.

True or false: Conventional loans and conforming loans are exactly the same thing.

Loans can be a bit confusing, especially if you’re new to the loan process. Odds are if you’re searching loans near me, you’ll come across the concept of conventional loans and conforming loans. These loans are not the same and each have distinct guidelines. Conventional loans are essentially mortgage loans given out by mortgage lending institutions. They are not backed by an agency of the government such as the US Department of Veterans affairs or the Federal Housing Administration. A conforming loan is a loan that conforms to the guidelines set out by Fannie Mae and Freddie Mac. The main guideline on the loan is the maximum loan amount. This amount can vary depending on the location of the home. For example, a house in a high income area will be eligible for a larger loan than one in a general income area. Other qualifications that must be taken into account are your personal debt-to-income ratio, the loan-to-value ratio, and credit history. Keep in mind these factors when applying for a loan.

Loans Near Me – Loans Facts

Secured Loans

One of the more common loans you’ll encounter when searching loans near me is a secured loan. What exactly is a secured loan and what can you do with it? With a secured or collateral loan, you can leverage personal property in order to obtain the loan. If you default on your loan, the property is then transferred to the lender. The interest rate and the loan amount will vary greatly depending on the value of the property you are leveraging. In general, the higher the value of the property, the larger loan and better interest rate you can secure. Of course, factors such as length and credit history will also be taken into consideration. So what can you use a secured loan for? Examples of personal property that can be used to secure a loan include: houses, vehicles, savings accounts, CDS, and other high valued possessions. Secured loans can be a bit risky, but so long as you pay on time and keep tabs on your loan at all times, you should face zero issues.

Open Ended Loans

Another loan type you’ll encounter on your journey to find loans near me is an open ended loan. As the name states, open ended loans are loans with a fixed limit line of credit. This line can be borrowed from again and again and again so long as they have been fully repaid. Credit cards are just one type of a n open ended loan. A home equity line of credit is another example of an open ended loan. These loans work like this: the lender will approve you for a certain amount of credit based entirely upon a percentage of your home’s current appraised value. The amount you owe on your mortgage will automatically be deducted. The sum acts as a credit line you can borrow from and then pay back and then borrow from again. This is great for those looking to remodel their homes and need a constant line of credit to borrow money from when trying to make all of the necessary repairs. Of course, the best loan for you is the one that suits your lifestyle, your financial goals, and will be easily repayable. Don’t get in over your head with a loan and you’ll be just fine. If you pay on time, they will actually improve your credit.