Navy Federal Near Me

Deciding to go with a credit union rather than a traditional bank can offer many individual benefits and can help you to get your financial life in order. Navy Federal is a renowned US credit union headquartered in Vienna, virginia. It is the largest retail credit union in the US both in terms of asset size and membership. If you’re looking for a credit union that can serve you throughout your financial life, Navy Federal should definitely be in the running.

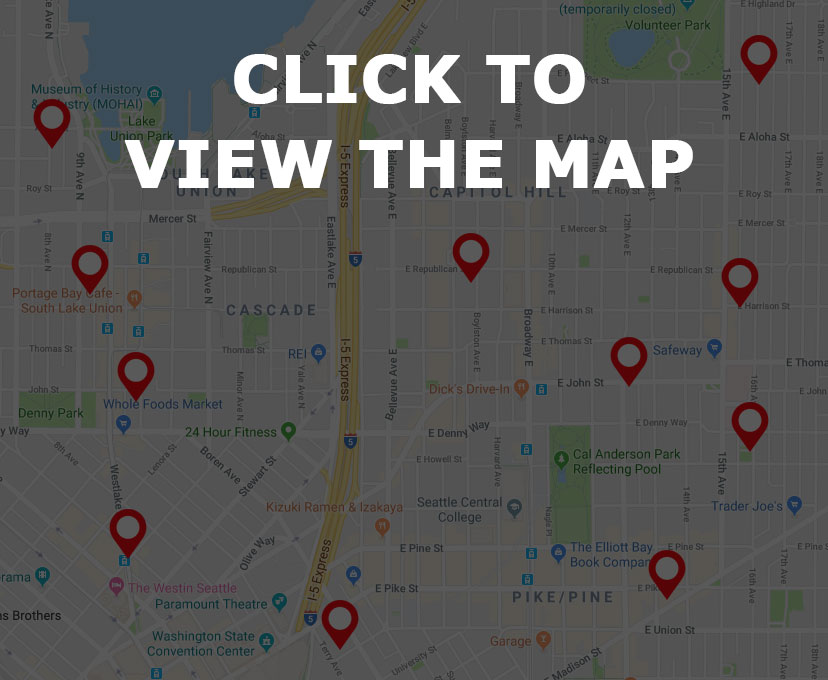

Are you interested in finding a Navy Federal location near you? You’re in luck! Simply browse Navy Federal near me on the map below and find a list of locations in your area. Need a bit more information on credit unions and Navy Federal? Read on for tips, trivia, facts, and more. You’ll go into your credit union experience feeling more informed than you were going in!

Navy Federal Near Me – Find it on the Map

Navy Federal Near Me – Navy Federal Trivia

What is a credit union?

If you’re searching Navy Federal near me, then you probably already have a good idea of what a credit union is and what they do. For the most part, credit unions and banks offer many overlapping services-savings accounts, checking accounts, loans, and more. In the case of both banks and credit unions, accounts are all federally insured up to $250,000. The major difference between a credit union is a bank is that a credit union is a not for profit organization. It exists to serve its members. Though a credit union can accept deposits and offer a wide array of financial services, they tend to have lower rates and often don’t charge fees. Credit unions are often seen as a safer option for anyone just getting started on their financial journey or who would enjoy a bigger safety net.

Navy Federal credit union is one of the best credit unions in the US.

Which president signed the Federal Credit Union Act?

Credit unions haven’t always been an option to thrifty Americans or those looking for an alternative to traditional banking. In fact, it wasn’t until 1934 that credit unions were truly brought to the forefront. Which president signed the Federal Credit Union Act? Consider this as you search Navy Federal near me. President Roosevelt is credited with signing the Federal Credit Union act in 1934 to promote thritiness and prevent usury during the arduous years of the Great Depression.

Are all credit unions insured?

As you search Navy Federal near me, you may be wondering if all credit unions are insured. Generally speaking, all credit unions are insured. Almost every credit union is insured by the National Credit Union Administration, which can provide the same coverage and funds as a traditional bank. If the word federal is in the name of the credit union, then they are insured. If not, you may want to check with the particular credit union you’re looking to work with. Some may be state chartered or have private deposits rather than working on a federal level. At the end of the day, what you need is based on your individual situation and your financial portfolio.

Navy Federal Near Me – Navy Federal Facts

ATM Presence

One drawback that some credit unions face is having a lack of ATMs in their network. Historically speaking, smaller institutions and credit unions tend to have a lower number of physical branches. This can mean that free ATMs are not abundant, especially if you life in a more rural area. Despite this, many credit unions have found great ways to compete with national banks in terms of offering free atm services. Consider this as you search Navy Federal near me. A majority of credit unions have taken to joining fee-free ATM networks such as MoneyPass or AllPoint. These networks are always free to use no matter who you choose to bank with, which can be a great resource if ATM fees are a major concern for you. Some also belong to co-op networks of shared ATM branches, meaning that the branches do not belong to one single bank. For credit unions that don’t have a massive ATM network, many will offer fee reimbursement up to a certain amount each month. This means that you can use any ATM you encounter without having to worry about mounting fees against your account. If you’re someone who relies on ATMs or physical banking locations quite frequently, you may want to look into the size of a particular credit union’s network and just how many ATMS exist in your local region.

The Pros And Cons

While you’re searching Navy Federal near me, you may want to weigh the pros/cons of going with a credit union rather than a traditional bank. When you choose to go with a credit union rather than a bank, there will be some benefits and some tradeoffs. One of the major benefits of a credit union is that they almost always provide better customer service and a higher degree of customer satisfaction. Since credit unions are more customer based, they tend to go the extra mile for those who choose to work with them. Credit unions will also offer higher interest rates on deposits, lower rates on personal loans, and lower banking fees for accounts. The downside of a credit union is they are typically not as technologically advanced as major banks. Banks tend to adopt new technology and tools rather quickly. They also tend to offer apps and online banking services that many credit unions do not.