Santander Bank Near Me

With so many banks to choose from– finding the right one is often about as easy as digging that needle out of a haystack. Still, banking is a total necessity for every working American. When searching for a bank near me, consider Santander bank. With low fees and multiple account options, you’ll always feel like you’re getting the most from your bank without having to pay exorbitant monthly fees or dealing with minimum debit purchases.

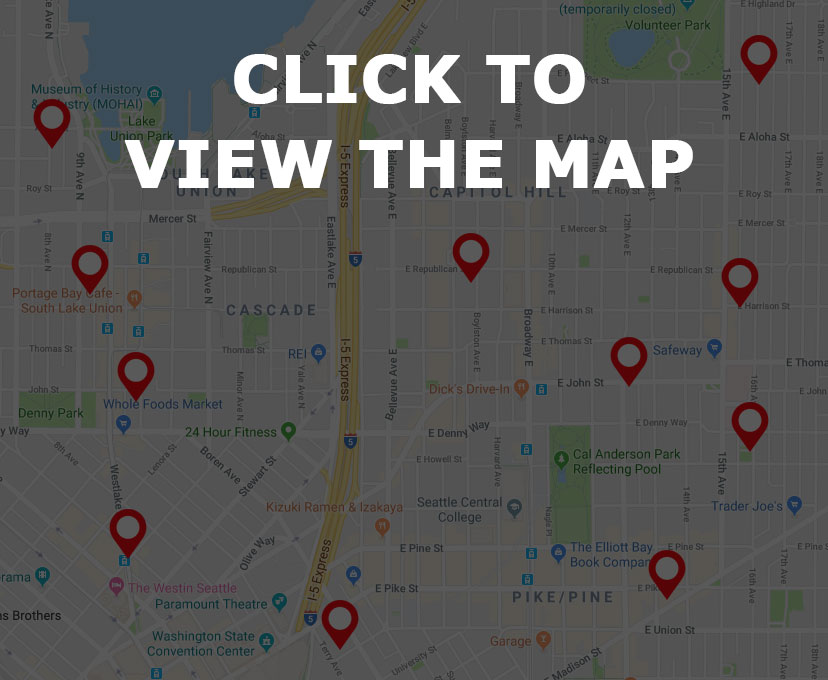

Seeking a Santander bank in your area? Simply browse Santander bank near me on the map below and find a list of locations in your local area. Need a bit more information on this famed bank? Read on for facts, trivia, and tips. We’ll give you insight on fees and debit card usage without the hassle of dealing with a banker!

Santander Bank Near Me – Find it on the Map

Santander Bank Near Me – Santander Bank Trivia

What is the Santander bank?

Santander bank has the privilege of being an institution that dates back hundreds of years. While many of us equate banking with being a more modern endeavor, Santander was actually first founded in 1857. So what is Santander bank? Consider this as you search Santander bank near me. The Santander banking group is a group of global retail and commercial banks. With over 102 million customers and more than 14,000 branches, Santander is one of the top baking institutions in the entire world. In fact, Santander currently boasts more locations than any other bank. Since its founding in 1857, Stander has become the leading bank in the United Kingdom, continental Europe, and Latin America. It is known as a strong and stable financial institution that stays free of controversy or customer dissatisfaction. Santander currently operates in 9 major international markets. In addition to the US, locations can be found in the UK, Brazil, Germany, Mexico, Poland, Argentina, Chile, Spain, and Portugal.

Santander bank can be found in nearly every country, including the US and Mexico.

Can you use your Santander debit card out of the country?

Let’s face it– we all love to travel. Few things are as exciting or eye opening as traveling to other countries and exploring countries aside from our own. Yet, there are some major things to consider before hitting the road or sky. Like, will you be able to use your Santander debit card outside of the country? Many banking institutions will not allow you to use debit or credit cards outside of the US. This can make travel complicated as you will often have to rely on travelers checks or exchange currency when arriving at your destination. Not exactly easy or time friendly. Santander understands that the eager traveler shouldn’t be punished for going abroad or to another country. That’s why both Santander debit and credit cards can be used outside of the country. However, for your protection, many transactions made outside of your normal spending routines are sometimes denied. So even though you can freely use your debit or credit card outside of your home country, it is always recommended that you notify Santander by phone prior to traveling. This will put a note in your profile that will keep your transactions from being denied. This can help you to avoid a situation in which you no longer have access to your funds. If you’re planning on traveling while searching Santander bank near me, consider calling ahead of time to avoid any issue come payment time.

Santander Bank Near Me – Santander Bank Facts

Are there fees on a Santander debit card?

Is there anything worse than accruing fees from simply using your debit card? Some banks will charge you for simply using your debit card too often. Others will charge a fee if you don’t use your debit card enough. What about Santander? Are there any fees on a Santander debit card? According to the brand, you will not be charged a fee for using your debit card nor is there a max or minimum amount of times you must use your card per month. When it comes to ATM fees, you will not be charged if you make a withdrawal from a Santander ATM or one of its division branches. You will also not be charged a fee when withdrawing funds from your checking account or savings account. However, if you’re searching Santander bank near me, keep in mind that you will be charged a fee if you use a non-Santander ATM machine. For example, if you have a basic checking account, you’ll pay a $3.00 fee. A student account will be charged a $2.00 fee.

Santander Monthly Fees

No one likes to pay monthly fees at the bank, but it’s often a reality for many Americans who don’t have much of a choice. When it comes to banking at Santander, there may be some monthly fees to keep in mind depending on the type of checking account you have and the type of transactions that you are performing during the month. Right now, Santander requires that some accounts keep a minimum balance each month. If the balance falls under the minimum any day during the month, a monthly service charge may be processed. Fall under your limit multiple times and you will be charged multiple fees. You can also be charged a fee for using a Non-Santander ATM. Of course, with so many Santander atm locations to choose from this can easily be avoided. Some accounts at Santander may also be subject to a monthly maintenance fee. This fee is generally pretty low and will often go unnoticed. How can you avoid fees while searching Santander bank near me? Keep an eye on the type of account you have chosen and any requirements on that account. If you need to keep a minimum balance, do so. Also make sure that you don’t accrue excess spending fees or non-Santander ATM fees. By being cognizant of these things, you can avoid a build up of fees and keep your hard earned cash.