Tax Lawyer Near Me

After April 15th rolls around- you probably don’t want to have to think about taxes for another year. Unfortunately, the IRS has its fingers in all kinds of pies, meaning there are many circumstances in which the IRS may get in touch with you. Whether for an audit or an underpayment, a tax lawyer can help you to navigate the crazy world of US tax laws.

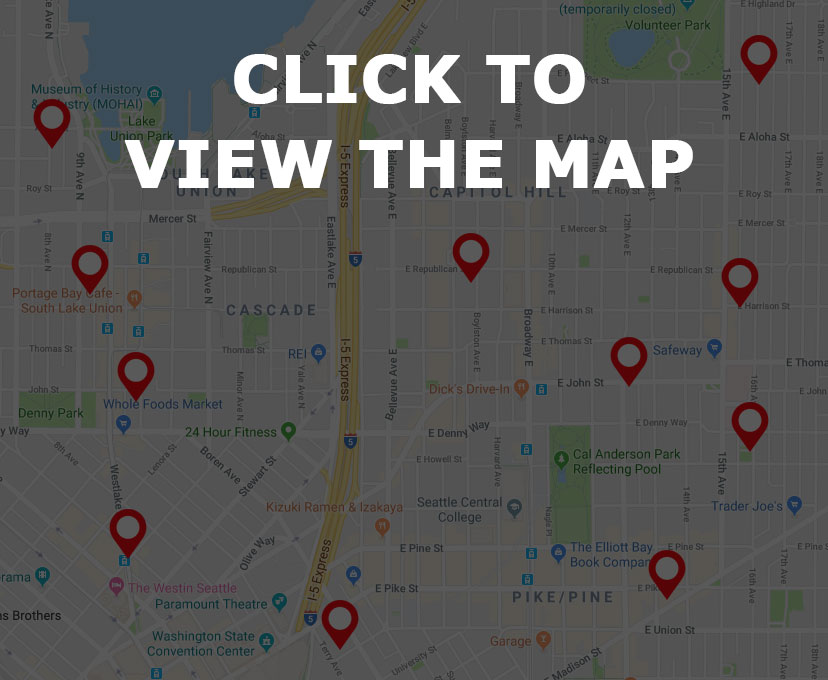

In need of a tax lawyer? Simply browse tax lawyer near me on the map below and find a list of qualified lawyers in your local area. Need a bit more information on tax law? Read on for interesting facts, trivia, and even more. You’ll know more about tax law than the average American!

Tax Lawyer Near Me – Find it on the Map

Tax Lawyer Near Me – Tax Lawyer Trivia

How much does a tax lawyer cost?

Much like the average attorney, tax lawyers need to make a living. Hiring a tax attorney won’t come without some major cost, especially if your case is complex or will require time in court. Just how much does the average tax lawyer cost? Consider this as you search tax lawyer near me. In general, tax lawyers will either charge an hourly rate or a flat fee for their services. A majority of tax attorneys will choose to charge by the hour. The hourly rate can vary dramatically between attorneys, especially if you live in a very wealthy or urban area. Most attorney will charge between $200 and $400 per hour, but some more experienced attorneys or those employed by big firms can charge as much as $1,000 per hour. Another payment option is the “flat fee.” This is a one time fee that you’ll pay regardless of how many hours the attorney is forced to spend on your case. Flat fees are only really used for really simple matters. More complex cases will almost always be accompanied by an hourly rate. Which type of payment is better? Well, there are some benefits and drawbacks to both types of fees. An hourly rate is often attractive because you don’t run the risk of overpaying should the attorney not be able to resolve your work quickly or if the case ends up taking very little work. On the other hand, you may run the risk of paying higher legal fees if the case does take more time than originally expected. This is why most clients prefer a flat rate, which allows them to lock in a certain cost when hiring an attorney.

A great tax lawyer can help you navigate the tricky world of tax law!

Why do people hire tax attorneys?

People seek out the services of a tax lawyer for many reasons; whether they need advice on their estate or starting a new business, the services of a tax lawyer can be beneficial. But what’s the main reason that many people hire tax attorneys? Consider this as you search tax lawyer near me. Without question, notice of a tax audit is the number one reason that people seek out a tax lawyer for help. Audits are a nightmare. Not only could you potentially end up paying more in taxes or penalties, but there are a lot of hurdles to jump through during the whole auditing process. Because the process of an audit counts as a legally binding contract between the audited taxpayers and the agency, people should always approach an audit with the same caution that they would when going to court for a civil case. You would never want to go into court without representation, so why would you want to enter into an audit without a tax attorney by their side? An attorney can truly be key in making the audit as smooth as possible. A person’s lawyer may even be able to compromise the tax debt and set up an installment agreement.

Tax Lawyer Near Me – Tax Lawyer Facts

Estates and Inheritance

Another major reason people search tax lawyer near me is to deal with matters of estates and inheritances. The government doesn’t only collect taxes on income or what you bring in through your various jobs or income streams. They can collect taxes through many channels, including through what people receive on estates and inheritances. A tax lawyer is an incredible asset when people want to prepay or repay the taxes on an estate before it is bequeathed to heirs. The attorney can also make sure that the right amount of money has been paid and that the IRS has no reason to come after the recipients of the estate.

Similarly, those who receive inheritances may have to claim money on their returns if the giver did not already pay the taxes on these gifts. A qualified lawyer can find out for sure if the money has been prepaid or whether the gift even needs to be included on the participants returns. This can really help clarify the process of getting an inheritance, especially if those receiving the money are grieving or aren’t familiar with US tax law.

It goes without saying that the IRS is very forthcoming when it comes to collecting taxes for the government. This is because every single person to needs to pay their fair share, forcing the agency to reach out to those who are behind, absent, or withholding information. The only way to avoid getting into trouble with the IRS is to rely on a qualified tax lawyer to help navigate the waters and clarify what tax laws really required.

What’s the average tax refund in the US?

Everyone loves to get a big tax return, but how many of us actually get what what we feel we deserve? As you search tax lawyer near me, consider the average tax refund in the US. According to statistics, the average refund is almost $3,000 or $2,943 to be totally exact. All in all, over $325 billion in tax refunds are paid out annually. While a big refund may be great come April, all it really suggests is that you were having too much withheld from your pay or your estimated tax payments were far too large. Tax refunds essentially work as interest free loans to the government. Often times a very big refunds simply means you gave the government an extraordinarily large loan. If you’re not sure if you’re overpaying, consult a tax attorney and find out what needs to be changed come April 15th of next year.