Title Loans Near Me

If you need some quick cash or just need to unload a vehicle for some money, a title loan is the best option for you. Title loans are a great way to get quick cash for your vehicle without having to go through other channels that may check your credit history or give you the runaround.

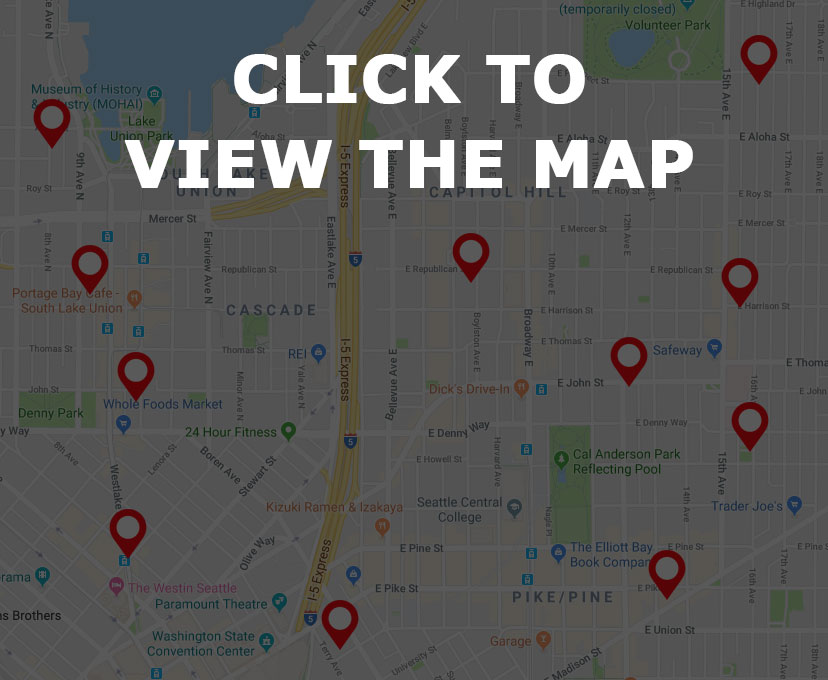

Are you interested in finding title loans near you? Simply browse title loans near me on the map below and find a list of banks and businesses currently offering title loans in your area. Need a bit more information on title loans? Read on for facts, trivia, and useful tips for procuring a title loan. You might just learn the ropes before stepping foot in the store.

Title Loans Near Me – Find it on the Map

Title Loans Near Me – Title Loans Trivia

What is a title loan?

You may be searching title loans near me, but that doesn’t mean you’re well versed on what a title loan is, what it does, and what it means for you in the long run. And even if you are an expert on all things title loans, it doesn’t hurt to refresh your memory. A title loan (also known as a title pawn in several states), is a very quick and convenient way for people who own their car or motorcycle outright to get cash in hand as quickly as possible. These loans are a popular option for individuals who may not be able to get a loan at a bank. There are some serious pros and cons to getting this type of loan. A great advantage of title loans is that even though you are putting up the title of your car, you can still keep your car, as well as drive it during the loan period. However, this can also put you at risk of permanently losing your car should something go awry. Regardless, a title loan can help you get money without a big shift in your lifestyle change. Title loans essentially work by you putting up your car title as collateral for security of your debt. Because of this, there is no need for a credit check to be performed. This allows anyone who has a car (that they own) to get a loan no matter what credit history they may have. In the case of default on the loan, they will sell your car. This won’t impact your credit, but you will end up losing your vehicle. Weigh the pros and cons before taking the plunge and figure out what actually works best for you. If a title loan is in your future, you’ll be fine so long as you workout a responsible financial plan and stay current.

There are many ways to procure a title loan with ease!

Do title loans come with high interest rates?

Unfortunately if you’re searching title loans near me, you need to prepare yourself for some pretty high interest rates. Given that car title loans are most often short term loans, a 90 day title loan would certainly qualify as a short term loan. During this time, you will end up paying a ton of interest. It’s just the nature of the beat when it comes to short term title loans. The rate may only be around 25%, but that is just the monthly interest charge. This is the equivalent to approximately 300% APR, which is an enormous rate that will end costing you a lot more in the long run. The auto title loan rates only steepen, and they will go up significantly if you fail to pay your debt on time.

Title Loans Near Me – Title Loans Facts

Risk of Car Loss

Though taking out a title loan can be a great idea in a variety of circumstances, there are also some cons to consider before taking that next step after searching title loans near me. One significant fear that many title loan payers have is the risk of losing their car. Even though you will be able to keep your car throughout the period of the loan, if you do not pay off your loan within the 90 day period, you are actually at a high risk of losing your vehicle. Taking a loan against your car is a big risk. It’s the same kind of risk that goes for individuals who take a loan against their home. Though there’s a lot of focus on positive outcomes, there have been some bad experiences as well. It is within the rights of the lender to repossess your car and the sell it. Since the car is put as collateral They can take it away as your payment for the defaulted loan. What’s even worse is that they will get even more money, because typically they will only let you borrow around 50% of the car’s total value. They will sell your vehicle for double. Not only would you be out of a car, but you’d be cheated out of a lot of money that should have gone in your pocket. In a lot of ways, title loans are not for everyone. Know your exact needs and options for repayment before truly embarking on the process of gaining a title loan.

Liability

Consider this if you’re searching title loans near me. If a case where you do lose a car should arise during the process of having a title loan, you won’t have to pay your debt off in its entirety. However, if they sell your car and get less than what was owed from you, you are still 100% liable for the difference. This means that you could end up losing your car and still having to make payments depending on how much your car was worth. Of course, this is pretty much the worst case scenario and most individuals who take out title loans are never faced with these kinds of hardships or challenges. If you simply play by the rules, pay your loan off within the agreed upon time period and do what’s expected of you, you’ll have a flawless experience. If you fall on hard times and cannot pay based on the agreed upon terms, you may face a few more hurdles than the average title loan taker.