Bankruptcy Lawyer Near Me

best laid plans. Sometimes, financial difficulties or medical bills can affect your ability to pay bills, loans, or other obligations. Navigating the steps that can help to free you from your financial difficulties isn’t easy, but with a great bankruptcy lawyer, it is possible.

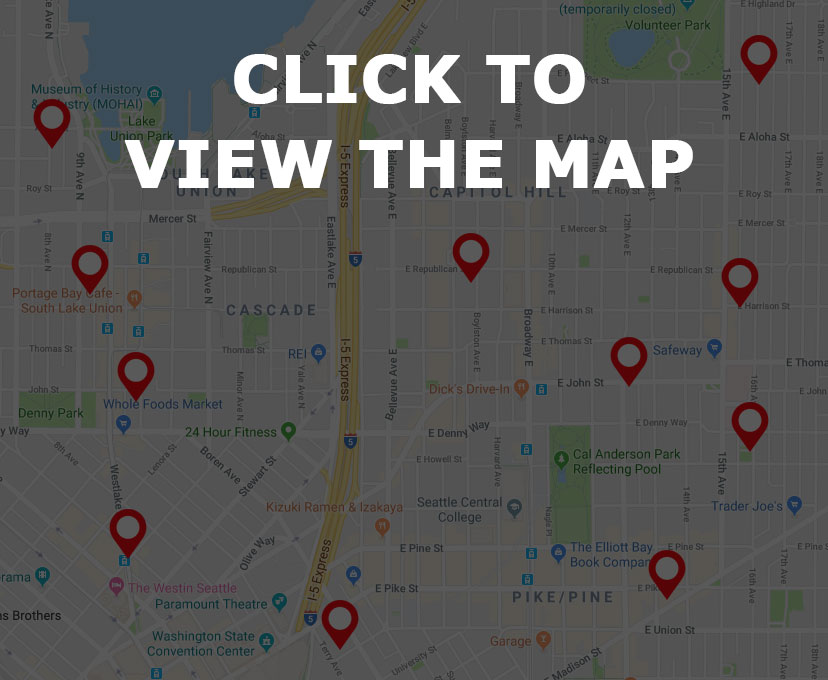

Need a bankruptcy lawyer? Simply browse bankruptcy lawyer near me on the map below and find a list of great bankruptcy lawyers in your local area. Need a bit more help understanding bankruptcy? Read on for facts, trivia, and insights on the process. You’ll know exactly what you’re getting into!

Bankruptcy Lawyer Near Me – Find it on the Map

Bankruptcy Lawyer Near Me – Bankruptcy Lawyer Trivia

Do I Qualify For Chapter 7 Bankruptcy?

Even if you carry a lot of debt, you may not qualify for chapter 7 bankruptcy. Before you can file Chapter 7, you’ll need to pass a means test. What exactly is a means test? Consider these facts as you search bankruptcy lawyer near me. To pass a means test and file for chapter 7 bankruptcy, you’ll have to have little to no disposable income. This means, all of your income must be spoken for through necessary means- bills, food, and housing. Disposable income is leftover income that you would generally spend on non-necessity items such as clothing, travel, or recreation. To determine whether or not you qualify for Chapter 7 bankruptcy, the means test will compare your average monthly income for the six month period that precedes your bankruptcy against the median income of a comparable household in your state. If your income is below the median, then you will automatically qualify. Median income figures will vary from state to state. For example, the state of Florida has a median income threshold of $41,065 for a household of one person. Generally, anyone having financial difficulties don’t have much in the way of disposable income, so you likely won’t have to worry about whether or not you pass a means test.

Bankruptcy happens to the best of us, find a great lawyer to help you navigate the process.

Is there a minimum debt amount for bankruptcy?

As you search bankruptcy lawyer near me, there are many factors to consider when declaring bankruptcy. For example, is there a minimum debt amount for bankruptcy? How about a maximum? Right now, there is no minimum debt requirement in bankruptcy. The amount of debt you have is an important consideration, but it is not the only consideration to be made. What truly influences a bankruptcy are a few general factors:

-Are you able to repay your debts outside of the realm of bankruptcy?

-Are creditors willing to work with you to repay your debts?

-The facts of your particular case.

While there is no minimum threshold for bankruptcy, the is a maximum debt limit for chapter 13. According to federal laws, you cannot have more than $1,184,200 in secured debt or $394,725 in unsecured debt if you would like to file Chapter 13 bankruptcy. Keep in mind, these amounts will be adjusted every so often to keep up with inflation.

Bankruptcy Lawyer Near Me – Bankruptcy Lawyer Facts

Curb Your Default With Chapter 13

Are you searching bankruptcy lawyer near me in hopes of filing a Chapter 13? If you’re struggling to pay your mortgage or have already defaulted on your loan, Chapter 13 may be the best option for you. A Chapter 13 bankruptcy is referred to as a reorganization bankruptcy because it will allow you to reorganize your debts and pay them off gradually through a convenient repayment plan. This plan will include any missed mortgage payments. In fact, you will be required to cure your mortgage woes if you plan on keeping your home. Depending on your annual household income, your Chapter 13 plan can last anywhere between three years and five years. Typically, this type of plan cannot exceed five years. This means that you will generally be able to cure your mortgage woes by paying only a small portion of the default each month. While continuing to pay your mortgage during a Chapter 13, you will become current on your payments by the time you complete your plan. As a result, filing for Chapter 13 will provide an easy way to stop foreclosure proceedings and catch up on those missed mortgage payments.

Stop Harassment from Debt Collectors

Few things are as stressful or disheartening as being hounded by credit collectors both at home and at work. Sometimes, these calls can make the ring of a telephone feel foreboding or anxiety inducing. No matter what state your credit is in, you deserve to be free of harassment when it comes to debt collectors. Many times, folks want to search bankruptcy lawyer near me and file simply to get creditors off their back. If your main concern while filing for bankruptcy is stopping those harassing calls and emails, bankruptcy is an option but its not necessarily your best bet. Instead, try to get creditors off your back by taking advantage of the many federal and state debt collection laws that can protect you from abusive conduct at the hands of these collectors. You can also seek help from a credit counseling agency or by negotiating with your creditors. If you have some income or assets that you may be able to sell, you can negotiate with creditors rather than filing from bankruptcy. In the very least, negotiation can buy you some time and help you to get your ducks in a row. Some may even agree to settle your debts for far less than you owe!