BB&T Near Me

BB&T is one of the nation’s leading banking institutions when it comes to helping ordinary people to reach their financial goals and plan for a sound future. With checking accounts, savings accounts, investments, and insurance, BB&T offers modern banking services with an old school touch.

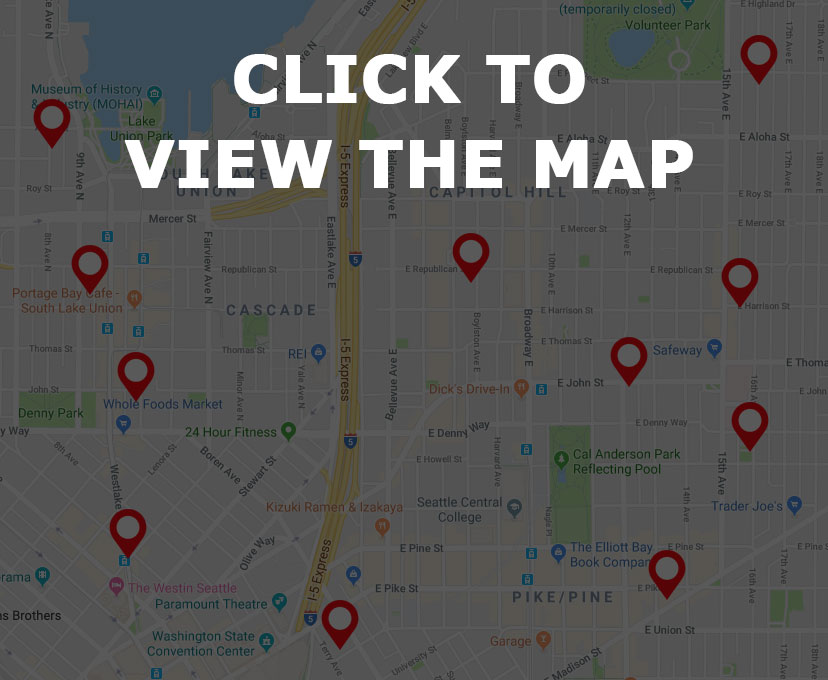

Are you interested in finding a BB&T near you? Simply browse BB&T near me on the map below and find a list of BB&T locations in a close proximity to your current location. Need a bit more information on BB&T? Read on for interesting facts, trivia, and more!

BB&T Near Me – Find it on the Map

BB&T Near Me – BB&T Trivia

When was BB&T first established?

Every great bank begins with a simple origin story, proving that a single idea can lead to great success with the right amount of patience and time. Consider these facts as you search BB&T near me. BB&T can actually trace its origins to 1872. This when Alpheus Branch and Thomas Jefferson Hadley launched a small bank called Branch & Hadley in the very small farming town of Wilson, North Carolina. This was during the midst of the Reconstruction era that took place after the Civil War. Much of the South was plunged into both political and financial chaos. Branch and Hadley made a name for themselves by helping local cotton farmers to maintain their businesses and frame a stable way of life. Branch eventually bought out Hadley in 1887, renaming the bank Branch and Company Bankers, the earliest derivative of BB&T. By 1900, the company was truly thriving due largely to the addition of lucrative tobacco farming practices in nearby towns. By this time, the bank had received a business changing charter form North Carolina and had gone through a couple of names before becoming the Branch Banking Company. It was officially renamed the Branch Banking and Trust company (BB&T) early in 1913. The rest is banking history!

BB&T is one of Americas most trusted and revered banking brands.

When did the number of services increase at BB&T?

As you already know while searching BB&T near me, a bank is only as good as the services they can offer the public at large. When exactly did the number of services initially increase at BB&T? According to bank historians, BB&T officially expanded the number of services offered in the early decades of the 20th century. This is when the bank began offering insurance and mortgages to the average everyday citizen. Around this same time, it became one of the very first banks in the region to open more branch offices, thus allowing it to triple its assets during the Great Depression. This was at a time when most banks were failing or closing their doors until further notice. BB&T stayed alive by offering smart services, tripling their assets, and keeping an eye on customer service.

BB&T Near Me – BB&T Facts

Entering South Carolina

When BB&T entered South Carolina, the bank received a massive bump in both exposure and in assets. BB&T first entered South Carolina during a merger with Greenville’s Community Bancorporation Inc. back in 1987. This is when the bank was renamed BB&T of South Carolina. With this new merge in tow, suddenly the company was expanding at breakneck speed. By the end of the decade, BB&T was holding assets worth more than $4.7 billion. The official holding company, which had been renamed BB&T Financial Corporation, had a total of 187 branches in a total of 105 communities across two states. Despite this massive amount of growth that was occurring in the 1980s, the bank was still a distant fourth in regards to North Carolina’s three biggest banking giants (NCNB, First Union, and Wachovia). Despite sliding into fourth place, it did lay claim on the distinction of being the oldest operating bank in the state. This gave the bank a lot more clout than its competitors. As you search BB&T near me, consider just how much clout the historical significance of BB&T holds for you when choosing a bank account. Does a bank’s history really matter to you?

An Emphasis on Reason

One reason BB&T has enjoyed so much consistent success for over a 100 years is the company’s strong emphasis on reason. Consider this as you search BB&T near me. In the company’s literature, they frequently quote Aristotle, featuring the quote, “We are what we repeatedly do.” It is this philosophy that has allowed for tremendous and consistent growth along with an emphasis on customer service. What BB&T repeatedly did for decades was buy banks. This allowed the bank to quickly grow into becoming of the largest consolidators in the Southeast. The company also took advantage of opportunities that many other companies did not, such as the savings and loan crisis of the 1980s. This allowed them to acquire healthy thrifts at bottom The management style at BB&T also stressed decentralization, striving for a community banking feel rather than a sterile corporate feel. This allowed BB&T to become a specialist in lending to small and medium sized businesses, making them a cornerstone of the communities they served.As you search BB&T near me, think about your personal life philosophy. Does it align with that of BB&T?